Incorporate your business: This legitimizes your intent to operate your own business independently of the companies you work for. Be […]

Over 50 years of legal experience for your protection

We use our knowledge and experience of Canada’s tax system to resolve your tax issues.

DioGuardi Law can also assist with Real Estate transactions (home purchase or sale, mortgages, etc) and Estate Planning (wills, power of attorney, trusts and probate).

We offer competitive services and advice on all residential real estate transactions.

WHY DIOGUARDI?

Tax amnesty is real legal protection

DioGuardi introduced the concept of Tax Amnesty to everyday taxpayers who have failed to file years of taxes or under-reported taxable income.

Tax Amnesty protects you from penalties and possible prosecution.

Legal protection is even more essential if the CRA is already demanding you file returns, or is looking for unreported income though an audit or net worth review.

When your tax balance is more than you can pay…

When you’re behind on filing returns…

When you’re facing an audit…

When CRA issues a lien on your home, wage garnishment or bank account freeze…

When anything about tax is keeping you up nights…

Call DioGuardi before you call any other kind of professional, and especially before you call an accountant.

The sooner you call, the more DioGuardi can do to protect you.

We protect clients against potential confiscation of assets and possible prosecution,

while offering tax amnesty for those who have yet to be caught for failing to file their taxes.

Experience

Paul DioGuardi has been practicing tax law since 1966, with vast experience and expertise in dealing with the Canada Revenue Agency (CRA) and the Canadian tax system.

Powerhouse Tax Law Services

DioGuardi Law has access to enhanced tax law services through DioGuardi Tax Law and Paul’s son, tax lawyer Philippe DioGuardi.

Real Life Tax Solutions

DioGuardi Law understands the pressures real people face in the real world. We apply our understanding and experience of the Canada Revenue Agency and their operational policies to protect you today and find an answer to end your tax dilemma.

Solutions

Personal and business tax issues

If you are facing any of the following situations, please contact us today:

If you are facing any of the following situations, please contact us today:

- Unreported income

- Unfiled tax returns

- Payment arrangements

- Tax balances beyond your ability to pay

- Tax dispute including objections and tax court appeals

- Criminal tax defense

If you are facing any of the following situations, please contact us today:

- Unreported income

- Unfiled tax returns

- Payment arrangements

- Tax balances beyond your ability to pay

- Tax dispute including objections and tax court appeals

- Criminal tax defense

Services

DioGuardi Law offers these services to assist both individual and business clients.

To complement our complete tax law offering, we offer other services to assist both individual and business clients.

About Us

DioGuardi is your one-stop resource for resolving all your tax-related personal and business issues.

- Tax Law

- Civil Assessment Negotiation and Litigation

- Criminal Prosecution Defense,

- Unpayable Tax Debt Solutions,

- Audits

- Tax Amnesty (VDP)

Our lawyers are also experienced in related business and personal financial matters such as wills, trusts, estate planning, real estate transactions, and incorporations.

- Real Estate Law

- Corporate and Commercial Law

- Wills and Estates

- Corporate Planning

Meet

the DioGuardi Lawyers

and team members

Brigitte DioGuardi

B.A., LL.B

Brigitte DioGuardi was called to the Law Society of Ontario (formerly the Law Society of Upper Canada) in 2002. She has been a member of the Bar of British Columbia and for 3 years ran the Vancouver office of DioGuardi Tax Law. Fluently bilingual in English and French, Brigitte has broad experience in all areas of our practice.

Paul DioGuardi

B.A., LL.B, KING’S COUNSEL, SENIOR COUNSEL

Paul DioGuardi is Senior Counsel to DioGuardi Law. He began his career at the head office of the CRA and Department of Justice. In his 50-plus years of practice he has amassed a vast knowledge of the legal issues related to tax, real estate and estate planning, and has authored several books on tax and other legal issues.

Joyce

Bruno

EXECUTIVE LEGAL ASSISTANT

Joyce Bruno has worked as executive legal assistant to Paul Dioguardi for 35 years and brings extensive knowledge and experience to the administrative tasks of client file management. She is invaluable and indispensable to the firm and manages the day-to-day running of the office.

Our Publications

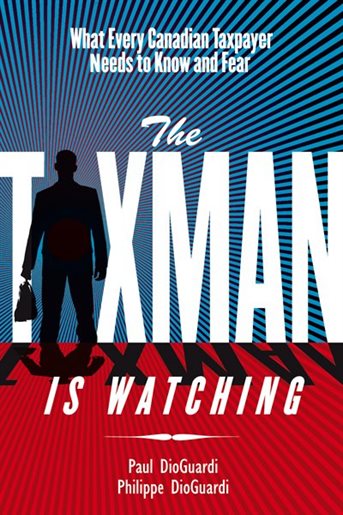

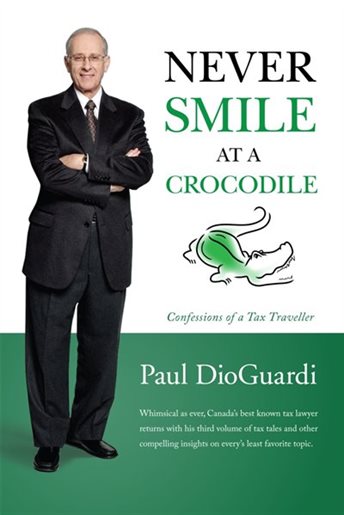

Paul DioGuardi, with his son tax lawyer Philippe DioGuardi, has authored three books on Canadian tax scenarios and taxpayer relationships with the Canada Revenue Agency.

Tax Amnesty: Avoiding the Tax Trap

A useful resource which explores, in a clear and non-technical way, the issues involved in obtaining a tax pardon. Pitfalls and potential problem areas are identified and real-world examples are provided on how the tax amnesty system operates.

The Taxman is Watching: What Every Canadian Taxpayer Needs to Know and Fear

A must-read for every Canadian taxpayer, THE TAXMAN IS WATCHING is the essential guide to your relationship with your tax obligations and the Canada Revenue Agency. It’s a wake-up call for anyone who still believes the government is on your side. Written in plain English, and peppered with real world case histories and at times amusing anecdotes, Paul and Philippe DioGuardi expose the true agenda behind audits and tax credits, and offer important guidelines on what NOT to say when the Taxman calls.

Never Smile at a Crocodile: Confessions of a Tax Traveler

A companion piece to THE TAXMAN IS WATCHING, this new book from tax lawyer Paul DioGuardi – with an important chapter by his son, tax lawyer Philippe DioGuardi – captures the spirit of adventure that inspired a young and fearless lawyer to devote his professional practice years to tax.

In over 50 years of practice, Paul DioGuardi has seen the best and the worst of the Canada Revenue Agency from both sides of the crocodile’s jaws. If you thought tax was only for accountants, this book will change your mind.

Latest Article

Contact Us

To Discuss your

Tax Situation

Call us now at

In Ottawa at 613-237-2222 (toll free 1-855-489-3555)

In Toronto/GTA at 905-212-9733

Or complete the form to request a consultation call.

If preferred, you may contact us via email at contact@diolaw.ca

Location

** NEW ADDRESS IN OTTAWA **

1505 Laperriere Ave, Suite 370

Ottawa, ON K1Z 7T1

(By appointment only)

We regret that we are not able to see walk-in clients.

** NEW ADDRESS IN OTTAWA **** NEW ADDRESS IN OTTAWA **

Monday – Friday 9:00 AM – 5:00 PM

OUR GTA ADDRESS IS AVAILABLE ON REQUEST

T: 613-237-2222

F: 613-317-2286

How can DIOGUARDI help you?

The use of this form or communication with the firm or any individual of the firm is not secure and does not establish lawyer-client relationship. Confidential or time-sensitive information should not be sent through this form.

Contact Us

Get the right advice from Canada’s tax law experts

Please call us at 613-237-2222 (toll free 1-855-489-3555) or complete the form to schedule a consultation to learn more about how DioGuardi Law can help with your legal needs.